Welcome to The Net Worth Network!

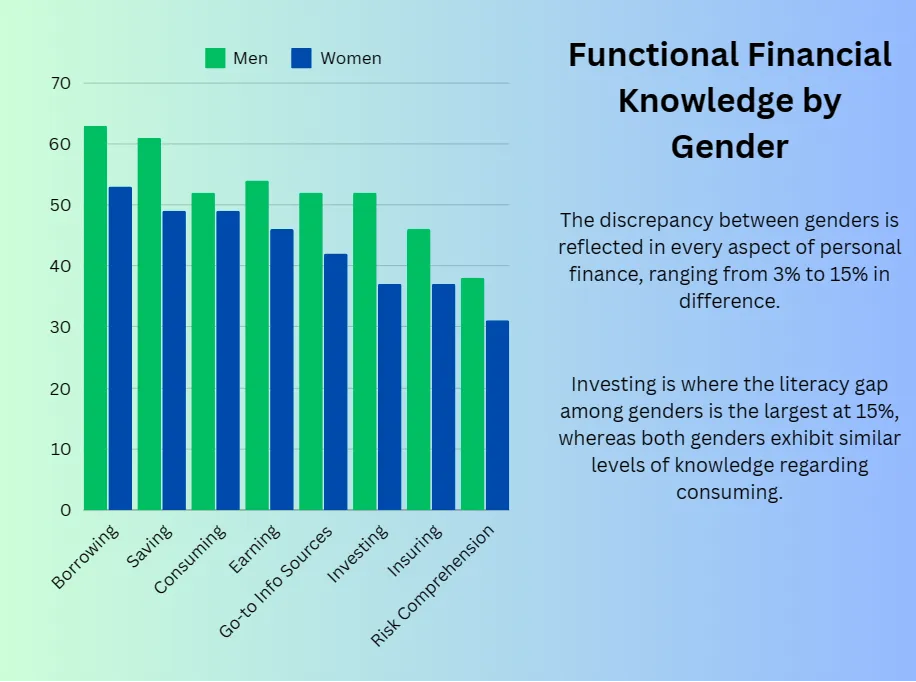

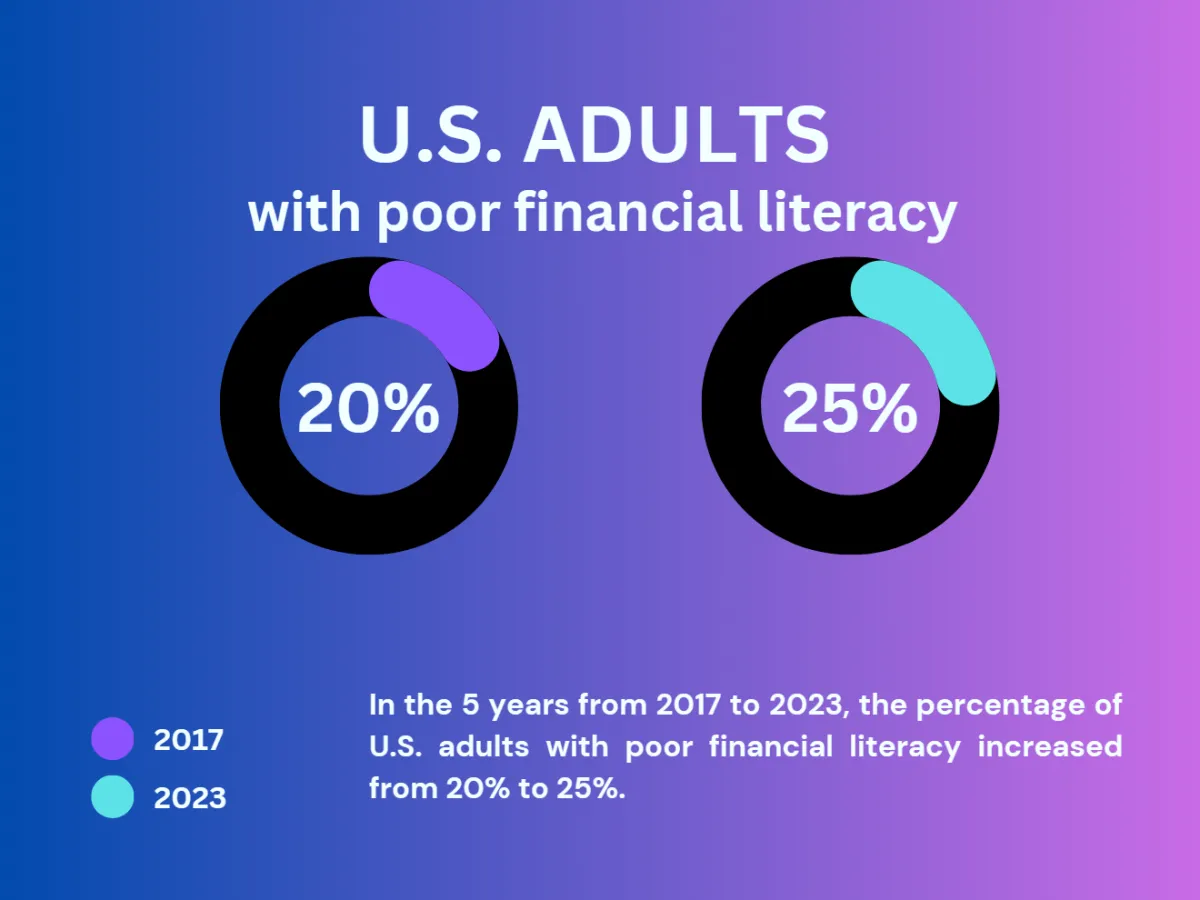

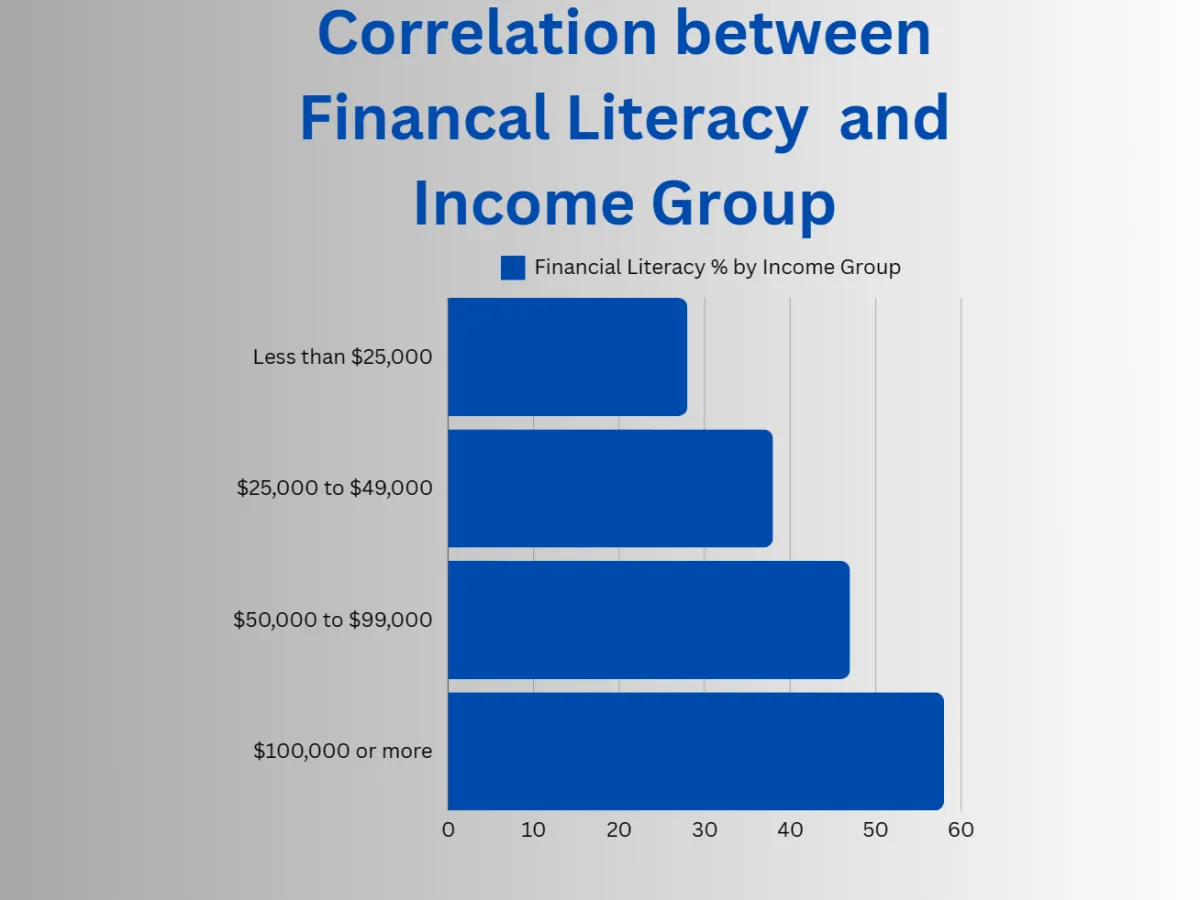

With statistics like this in the U.S., to say that there's room for improvement is an understatement! I want to do my part in sharing my financial independence journey, including strategies and tips in areas like budgeting, credit/debt, saving, investing, earning money online, the gig economy, small business topics and so much more!

The NWN is a community and resource hub for all things FIN LIT. Join me in spreading the knowledge and making a positive change in our society!

<meta name="fo-verify" content="38ac5d29-f6b6-4b03-b94c-ca62a3a1c220" />

Let's get

FISCALLY FIT

and

FINANCIALLY LIT

together!

Our site will be changing frequently as we are building the network, which launched in February 2024. I would love to hear feedback from you! What is the area that causes you anxiety? What would you like to learn more about? Take the New Audience Survey and let us know!

FINsight. FINspiration. You are FINough!

Hello!

I'm

Danielle

Founder, The Net Worth Network

Welcome to The Net Worth Network!

With statistics like this in the U.S., to say that there's room for improvement is an understatement! I want to do my part in sharing my financial independence journey, including strategies and tips in areas like budgeting, credit/debt, saving, investing, earning money online, the gig economy, small business topics and so much more!

The NWN is a community and resource hub for all things FIN LIT. Join me in spreading the knowledge and making a positive change in our society!

Let's get

FISCALLY FIT

and

FINANCIALLY LIT

together!

Our site will be changing frequently as we are building the network, which launched in February 2024. I would love to hear feedback from you! What is the area that causes you anxiety? What would you like to learn more about? Take the New Audience Survey and let us know!

Be sure to sign up with your best email address for updates, periodic newsletters, recommendations and offers on products and tools, and freebie giveaways!

FINsight. FINspiration. You are FINough!

Follow on Socials for Daily Content!

@thenetworth_network

About Me

Danielle Runyon

CPA, Educator, Content Creator, Student for Life

From an early age, whenever someone posed the question, "What do you want to do when you grow up?" I have responded with another question: "Is there such a thing as a professional student?" I have always loved school, and if I could, I would go back and master a new subject every few years!

Born in Indiana and raised across the River in Owensboro, KY, I eventually made the move to Lexington and attended the University of Kentucky, studying Accounting and Spanish, earning my B.S. in Accountancy in December 2007, and subsequently finishing up Spanish in 2008. I became a CPA (certified public accountant) and spent more than a decade working in public accounting with one of the best auditing practices in the world. And I believe I would have continued down this very expected path in life, except for the multitude of growth opportunities (a.k.a. crises, in the vernacular) that life threw at me in 2019. For the first time in my life I experienced true loss and grief, followed by a global pandemic.

This period of crisis meant I was taking a somewhat forced "gap year" which is how I now choose to look at it. A time of healing and exploration, this time off really allowed me to consider what a fulfilling and meaningful life would look like for the real me, who has a zeal for not only learning, but also for sharing knowledge, teaching. I began teaching part time at the community college, following in my parents' footsteps, but that's when the entrepreneur bug bit, and coincidentally, I received a sign that it was time to go for it. (If you are curious about this sign, check out the ENTRE Institute link on this site, under Partners and Offers.)

So in February 2024, I was able to launch my own online business, Rae Digital Enterprises LLC, and kicked it off with the flagship channel, The Net Worth Network. I now get the privilege of combining my knowledge of accounting and finance, my passion for education, and a brand new craving I have for artistic freedom and creativity.

Company Vision | Rae Digital Ventures LLC

Rae Digital Ventures LLC is a single-member LLC and is a digital business focused on developing digital properties and providing online services across a variety of niches. The Company was born out of my entrepreneurial aspirations that have been suppressed for over a decade. The long-term plan for the company is to build a service agency to help other small businesses accomplish their financial and marketing goals, as well as to build multiple virtual properties to develop content in collaboration with both affiliate marketing and education business models.

The Net Worth Network is the flagship brand of the Company, created as a result of my own battles with money at certain points in my life, combined with my long-time concern that an unacceptable percentage of people struggle with money matters, and that lack of education plays a large part in that struggle.

My vision for this channel is for a community and a resource for ordinary people like you and me to become empowered to make confident financial decisions and build an extraordinary life and legacy for their families.

PARTNERS

CURRENT OFFERS

My Financial & Lifestyle Blog

Here you will find all my new blog entries and articles about tips, strategies, products, tools to help you live your best financial life.

Let's get fiscally fit and financially lit together!

Under Construction - Coming Soon!

Book Recommendations for Money Mindset Mastery - The Currency of Success

“Books are the treasured wealth of the world and the fit inheritance of generations and nations.” – Henry David Thoreau

Key Takeaways

Discover the best books to cultivate a money mindset.

Learn how these books can transform your financial habits.

Understand practical applications from each book.

Explore additional recommended reads for financial mastery.

Introduction

It's critical to keep your learning going after traditional education, and books are the cheapest and easiest way to do so! Cultivating a money mindset is crucial for financial success, and one of the best ways to develop this mindset is through reading. But where do you start? Books offer a wealth of knowledge, insights, and strategies that can revolutionize the way you think about money.

When I started this blog, one of my goals was to keep an "evergreen list" of book recommendations. I've already started my list earlier this summer, so this is Part 2 to that list. You'll find my first list of 5 must-reads at the end of this article. And here, we'll explore the next list of 5 essential book recommendations for money mindset mastery.

These books have been carefully selected to help you shift your perspective, adopt new habits, and ultimately, achieve financial freedom.

The Laws of Human Nature by Robert Greene

Understanding Human Behavior

Robert Greene delves deep into the intricacies of human nature, providing a comprehensive understanding of what drives our actions and decisions. This knowledge is invaluable when it comes to making sound financial choices.

Influence on Financial Decisions

Understanding human behavior helps in predicting market trends and making informed investment decisions. Greene’s insights can help you recognize patterns and avoid common financial pitfalls. This is also a must for any entrepreneur or even someone starting a side hustle. Human behavior is the underlying key to all sales!

Key Takeaways

Mastering emotions to make rational decisions.

Recognizing and leveraging social dynamics.

Developing strategic thinking.

Practical Applications

Apply Greene’s principles to negotiate better deals, understand market psychology, and build stronger financial relationships.

Reader Reviews and Insights

Readers praise the book for its depth and practicality, highlighting how it has transformed their approach to both personal and financial relationships.

Pick up the Hard Copy here. Pick up the Paper Back here.

Or join Audible and get it for free when you start a 30 day free trial!

The Subtle Art of Not Giving a F*ck by Mark Manson

Challenging Conventional Wisdom

Mark Manson’s no-nonsense approach to life challenges the traditional beliefs about happiness and success. His philosophy encourages focusing on what truly matters.

Embracing Selective Focus

By caring less about trivial matters, you can direct your energy towards financial goals that genuinely matter, such as saving, investing, and debt reduction.

Financial Implications

Learning to prioritize your financial goals can lead to more disciplined spending and smarter investments.

Key Concepts

Embracing failures as learning opportunities.

Setting boundaries to protect financial interests.

Focusing on values-driven goals.

Real-World Examples

Manson’s book is filled with relatable stories that illustrate the power of selective focus in achieving financial stability. This tough-love approach and attitude is a nice change of pace from the "everything is rainbows" self-help books you see from other authors.

Pick up the hard cover here. Pick up the paper back here.

Or if you're like me, you love the audio book route: join Audible and get it for free when you start a 30 day free trial!

Start with Why by Simon Sinek

The Power of Purpose

Simon Sinek’s groundbreaking idea of starting with "why" emphasizes the importance of having a clear purpose behind your financial goals.

Impact on Money Management

A strong sense of purpose can drive better financial planning and disciplined saving, as every financial decision aligns with your core values.

Key Lessons

Identifying your financial “why”.

Aligning your actions with your purpose.

Inspiring others through your financial journey.

Implementation Strategies

Create a financial mission statement and use it as a guide for all your financial decisions. I learned about creating a personal mission statement through my online community of entrepreneurs (ENTREnation), and I have added my personal statement to my morning affirmation routine. You'd be surprised how much it impacts your decision making when you repeat it on a daily basis!

Reader Testimonials

Readers find Sinek’s approach empowering, noting significant improvements in their financial planning and goal-setting.

Pick up the hard cover here or the paper back here.

Or pick up a copy free as an audio book when you join Audible and start a 30 day free trial!

Mindset by Carol Dweck

Growth vs. Fixed Mindset

Carol Dweck’s research on mindsets reveals that those with a growth mindset are more likely to achieve financial success than those with a fixed mindset. Dweck is the one who coined "Growth Mindset" which you see more and more in the context of our paths to success using psychology today.

Influence on Financial Success

Adopting a growth mindset fosters resilience and a willingness to learn from financial setbacks, leading to long-term success. There's actual science and psychology behind this concept, and this book really helps you understand that. I don't know about you, but the more I understand how something works, the easier it is for me to apply it with confidence. Faith is important, of course. But I like having that little bit extra knowledge when I'm trying new methods for improving my mental well-being!

Key Insights

Embracing challenges as opportunities.

Learning from financial failures.

Persisting in the face of setbacks.

Practical Applications

Cultivate a growth mindset by setting challenging financial goals and viewing obstacles as learning experiences.

Reader Experiences

Readers share how shifting to a growth mindset has helped them overcome financial challenges and achieve their goals.

Get the Hard cover copy here. Or pick up the paper back version here.

Once again, there is an audio version, which I prefer! Get it for free when you join Audible and you start a 30 day free trial!

The Talent Code by Daniel Coyle

Unlocking Potential

Daniel Coyle’s book explores the concept of “deep practice” and how it can be applied to mastering any skill, including financial management.

Connection to Financial Mastery

Understanding the principles of deep practice can help you develop the skills necessary for effective financial management.

Key Principles

The importance of deliberate practice.

Building financial skills incrementally.

The role of mentorship and guidance.

Implementation Techniques

Apply deep practice to budgeting, investing, and other financial activities to improve your skills over time.

Reader Feedback

Readers appreciate Coyle’s actionable insights and have successfully applied his techniques to enhance their financial acumen.

You can get the hard cover version here or the paper back here.

Or pick up a copy free as an audio book when you join Audible and start a 30 day free trial!

Additional Book Recommendations

This will be an evergreen list of book recommendations, and Part 1 includes my first list of 5 must-reads in financial mindset mastery! You can find the first list here. Stay tuned for the next list when the seasons change!

FAQs

Why is a money mindset important?

A money mindset is crucial because it shapes how you think about and manage money. It influences your financial decisions, habits, and ultimately your success. A positive money mindset can lead to better financial health, while a negative one can result in poor financial choices and stress.

How often should I read financial books?

It's beneficial to read financial books regularly, aiming for at least one book every couple of months. Consistent reading keeps you informed, motivated, and continuously improving your financial knowledge and skills.

Can reading books really change my financial situation?

Yes, reading books can significantly impact your financial situation. Books provide knowledge, strategies, and insights that can transform how you think about and handle money, leading to better financial decisions and outcomes.

What should I look for in a good financial book?

A good financial book should be well-researched, practical, and aligned with your financial goals. Look for books with positive reviews, credible authors, and actionable advice that you can implement in your financial life.

How do I stay motivated to apply what I read?

Stay motivated by setting clear financial goals, tracking your progress, and regularly reviewing the benefits of the actions you take. Joining financial communities or finding an accountability partner can also help keep you on track.

Conclusion

Cultivating a money mindset through reading can be a game-changer for your financial future. The books recommended in this article offer valuable insights, practical strategies, and real-life examples that can inspire and guide you towards financial mastery. Start building your money mindset library today and take the first step towards transforming your financial life.

Disclaimer: Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. This website does not provide investment, financial, legal, tax or accounting advice. Some links are affiliate links.

The Net Worth Network | Rae Digital Ventures LLC All Rights Reserved 2024.

Earn More

From, to

Save More

HYSA, Retirement, and more

Tools and Products

Forecast apps and software / Budget builder apps, and more.

We want to hear from YOU!

The New Audience Survey is here! Share your opinion - what do you want to learn more about? What kind of content do you want to see?

Network Sign-up

Sign up with your name and best e-mail address below. This will ensure you get all the updates, and we'll be sending out blog entry notifications, periodic newsletters, and even some freebies, coming soon!

Contact Me

+1 (606)-5-FINLIT

2321 Sir Barton Way Ste 140,

Lexington, KY 40509

thenetworth_network

Copyright 2024 Rae Digital Ventures LLC DBA The Net Worth Network All rights reserved

Disclosure: I am a referral partner (also known as: affiliate) for the offers and products presented on this page and any related linked pages. I am not a paid employee. I may receive commission if you click a link or button on this page and choose to purchase something. You can rest assured I will only share things that I genuinely believe in and will truly be of value to you.

Facebook

Instagram

Youtube

TikTok